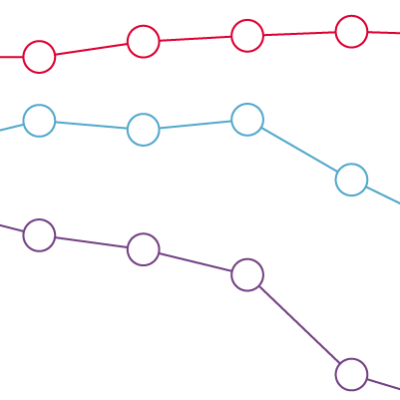

Housing affordability trends by tenure

10 April 2024

Key points

- 31% of people in households in the private rented sector are spending more than a third of their income on housing costs, compared with 13% of social renters and 3% who own their house with a mortgage.

- Private rents started to become less affordable in the 2000s, while social rents have become less affordable since 2010.

Housing affordability matters for health, both directly and indirectly. Difficulty paying the rent or mortgage can harm someone’s mental health, while spending more on housing leaves less income for other essentials that influence health, such as food and social activities.

This chart shows the proportion of households by tenure that are spending more than a third of their income (excluding housing benefit) on housing costs in the UK. Spending more than a third of household income on housing costs is an indicator of affordability problems.

- In 2019–22, 9.6% of all households in England were spending more than a third of their income on housing costs, which is equivalent to 6.3 million households.

- In 2019–22, 31% of households in the private rented sector were classed as having an affordability problem, compared to 2.7% of households that own their home with a mortgage. In the social rented sector, 13.3% of households spent more than a third of their income on housing.

- Trends in affordability have differed by tenure over the past 25 years:

- Affordability problems have increased in both the private and social rented sectors by 6.5 percentage points and 3.5 percentage points respectively in the past 10 years.

- In the past five years, the number of households with affordability problems in social rented homes has increased at a faster rate than in the previous two decades. One factor for this could be the reduction of government support for both social and private renters since 2013/14.

- In contrast, affordability problems have decreased by 3.9 percentage points in the past 10 years for households that own their homes with a mortgage. This partly reflects a prolonged period of low interest rates.

Recent trends in housing affordability are a continuation of a longer-term trend characterised by an increase in the proportion of households experiencing affordability problems within both the private and social rented sectors, and a decrease for households that own their home with mortgages, apart from a short period around the 2008 financial crisis.

- Housing affordability is measured here as housing costs (excluding housing benefit) divided by household income, and is adjusted according to household size to produce a ratio. If the ratio exceeds 0.33, the household is counted as having an affordability problem. Housing costs, including rent and mortgage interest payments, also include utility bills, such as water and council tax, as well as ground rent and service charges for owner-occupied homes.

- The chart shows a three–year smoothed average.

- Data for 2020/21 is not included in line with the Department for Work and Pensions’ guidance related to data quality during the COVID-19 pandemic.

- 2021/22 data have been affected by the pandemic and are subject to additional uncertainty. They should be viewed with caution and in line with broader trends.

Source: Health Foundation analysis of Department for Work and Pensions, Households below average income, UK, 1994/95 to 2021/22